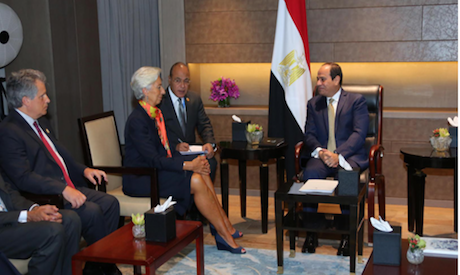

In an interview with the International Monetary Fund (IMF) Managing Director Christine Lagarde, she told Reuters that she would be spending the next several days speaking with senior officials in a number of countries to persuade them to contribute to about $5 billion to $6 billion in bilateral financing to support Egypt.

The funds are needed to allow a $12 billion IMF loan program to be approved by the Fund’s board.

She said, “The fact that Egypt has now reached an agreement with the IMF is an indication that they are taking their economic restructuring, their economic objectives seriously, and that should encourage either friendly neighboring countries or other bilateral partners to actually participate in the funding.”

While this is likely to include Middle Eastern and Gulf states that have historically supported Egypt, it also may include other countries that “are willing to chip in” to help Egypt reach its considerable economic potential.

Egypt has reached a preliminary agreement with the International Monetary Fund after nearly two weeks of talks to secure a $12 billion (9.25 billion pounds) lending programme.

Accordingly, Egypt is expected to adopt economic reforms programme in order to comply with the IMF’s requests including the value-added taxation, cutting subsidies and curbing wage increases.

In this context, Egypt’s parliament approved a long-awaited law introducing a value-added tax (VAT) of 13 %, rising to 14% in the next fiscal year. In response, several members of parliament from the 25-30 Alliance rejected the value-added tax (VAT) law that has been approved during session. MP Haitham Al-Hariri said, “The VAT will impose more financial struggle on citizens, which is not the right time for such a decision to be taken. The rate of inflation will see a significant incline.”

The VAT tax works on taxing businesses at each stage of production on the value added each time a commodity changes hands as it goes up the chain from a raw material to a consumer product. As a commodity moves up through the supply chain, each business has to pay taxes to the state.

The same principle applies to imported goods, which are taxed when they arrive in the country and each time they change hands after that.

Moreover, Egypt is planning to cut off fuel subsidies within three years and is aiming to increase fuel prices to 65 % of their actual cost during the 2016/17 fiscal year, according to two government sources.

One of the officials said,” What was agreed lately with the IMF delegation in Egypt is cancelling fuel subsidies within three years.”

The Gasoline in the 92-octane category is sold at 58% of its cost in Egypt while the 80-octane category is sold at 57% of its cost and for diesel, it is about 53%.

In July 2014 as part of a five-year plan, Egypt lowered its spending on fuel subsidies, which raised the prices of petrol and diesel by up to 78 %, but the plan was not followed through in 2015/16.

In April, government officials said there was a new plan to reduce spending on fuel subsidies by nearly 43% in the 2016/17 budget.

In 2015/16, the cost of petroleum subsidies fell to 55 billion Egyptian pounds ($6.2 billion) from 71.5 billion pounds last year.

Egypt targets to lower subsidies for petroleum products to about 35 billion pounds this financial year.

In addition, the Egyptian government is expected to cut off subsidies of other essential goods that will harm the poor people the most.

Many experts believe that IMF loan agreement will have negative repercussions on the Egyptian people and even the economy.

Amr Adly an expert in Carnegie said that the loan will cover current payments as the public deficit and the dollars’ shortage crisis which are all items without revenues and this strategy will enter the country in a borrowing loop in order not to get bankrupted. He said that it is similar model to what is happening in Greece.

Wael Gamal-an economic expert-said that Egypt will pay an expensive price in the future with the increase in the public and foreign debt and the absence in the foreign currency sources.

In the same context, Ehab Saeed -a financial analyst – said that there are negative impacts to the IMF loan as the increase in the debt.

He also added that there will be other effects on the social level as the government will most probably adopt austerity policies some will be related to the wages after the adoption of the civil service law that will lead to a strong wave of inflation.

Moreover, the economic expert and counselor Ashraf Dawaba said that the new loan will enslave Egypt as it will lead to floating the Egyptian currency, increasing the interest rate, and the inflation rate. He also added that it will decrease the wages, the subsidies on the fuel, but the taxes will increase. As a result, the IMF policies will ruin the Egypt’s fortunes, he said.

Despite the fears of the economic reforms programme, al-Sisi insists on seeking the loan with all his efforts. Al-Sisi called the Egyptian people to bear tough measures and hard times saying that there will be austerity measures the coming period.

Al-Sisi isn’t expected to transfer Egypt to a better condition through the IMF loan ,but it would lead to more economic and social crisis which will ruin the country in the end .

Last month,the Economist magazine has stated in its editorial entitled :”The Ruining Of Egypt” that Egypt under the al-Sisi rule is the most worrying country. “Nowhere is the poisonous mix of demographic stress, political repression and economic incompetence more worrying than in Egypt,” read the report.

Al-Sisi, the former Defense Minister who led the military coup in 2013 against the first democratically elected President Mohamed Morsi, has proved to be more repressive than Hosni Mubarak, who was toppled in the Arab spring,” said the Economist .

The regime is fragile as it depends only on the generous injections of cash from Gulf states, and to a lesser degree, by military aid from America. But, with all billions of petrodollars, Egypt’s budget and current-account deficits are gaping, at nearly 12% and 7% of GDP respectively.

As a result,the billion of dollars poured by the Gulf countries didint revive the Egyptian economy and the IMF loan agreement isn’t expected too to revive the economy but it would only increase the country’s foreign debt.

“Egypt’s political system needs to be reopened. A good place to start would be for al-Sisi to announce that he will not stand again for election in 2018,” concluded the Economist.