Non-oil private sector activity in Egypt contracted for the 30th. straight month in May, weighed down by continued high inflation and weak demand, a survey showed on Monday, reported Reuters.

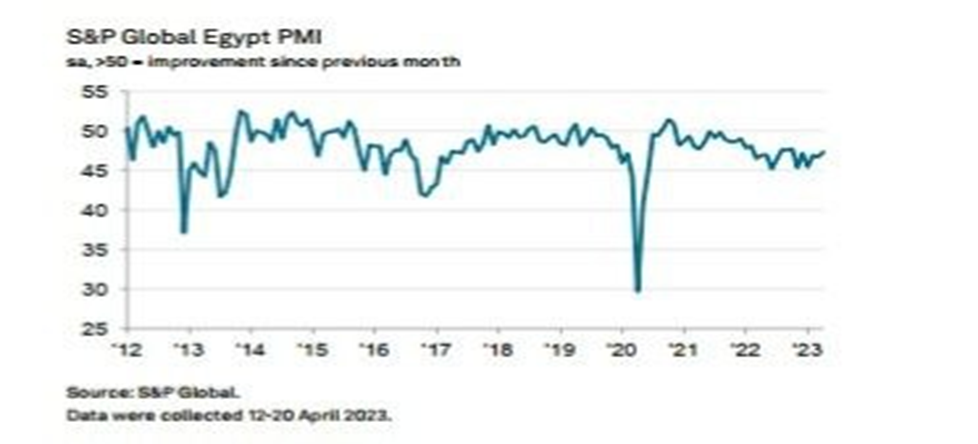

The S&P Global Egypt Purchasing Managers’ Index (PMI) strengthened to 47.8 in May from 47.3 in April, but remained well below the 50.0 threshold that marks growth in activity.

“Business activity levels continued to fall in the latest survey period, reflecting sustained efforts by companies to reduce output in line with weaker sales volumes,” S&P Global said.

“However, whilst solid overall, the rate of decline was the softest registered in almost a year-and-a-half, helped by near stabilizations in the manufacturing and services sectors,” it added.

May’s rate of contraction was the slowest since February 2022.

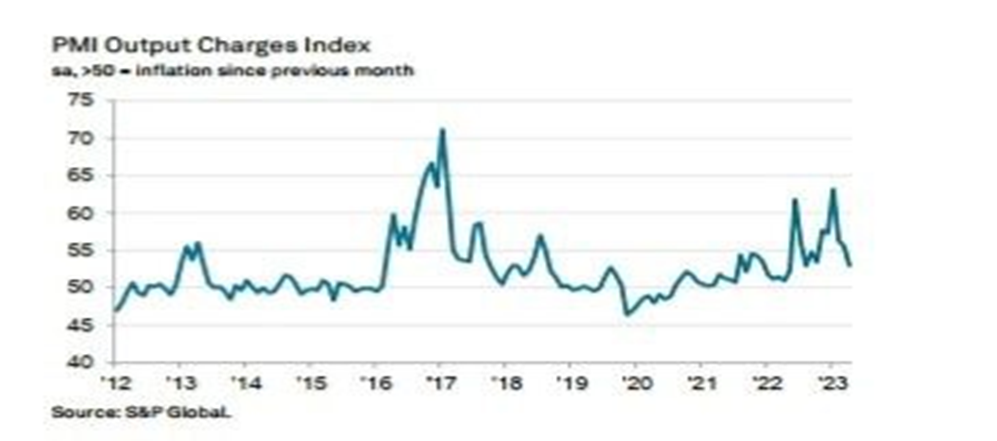

The PMI’s sub-index for overall input prices increased to 59.0 from April’s 58.7, and that for purchase prices rose to 60.1 from 59.9.

Annual urban consumer inflation slowed to 30.6% in April from 32.7% in March, the state statistics organization reported last month, while core inflation eased to 38.6% from 39.5%.

“The toll of rising input prices and weak demand meant that purchasing activity at non-oil businesses continued to decline, leading to a further contraction in firms’ input inventories,” S&P Global said.

“The pace at which input purchases decreased was the slowest seen since last October, however. Ongoing import restrictions meant that lead times on inputs lengthened, albeit only mildly.”

The new orders sub-index improved to 46.4 from 45.2 in April, while that for output rose to 46.3 from 45.4.

“While firms continued to report subdued demand that was largely attributed to inflation, some respondents began to see a recovery in client orders. Notably, new business intakes in the services economy grew for the second time in three months,” S&P Global said.

The sub-index for future output expectations strengthened to 53.2 from an all-time low of 51.4 in April.

“Despite the improvement, confidence levels were still among the lowest ever recorded, amid continued concerns about demand conditions, inflationary pressures and supply-side challenges,” S&P wrote. “Only 6% of companies were hopeful that output levels will expand over the coming year.”

Following is the PMI news release, in this regard:

S&P Global Egypt PMI (3 June 2023)

Downturn in business conditions softens in April as cost inflation drops to one-year low

Key Findings:

Output and new orders fall at softer rates

Input cost inflation drops below long-run trend

Business expectations down to record low

Egyptian non-oil businesses saw a further downturn in operating conditions in April, according to the latest PM survey data. The pace of decline softened to the weakest for six months, supported by a slower fall in demand levels and easing inflationary pressures. However, import controls and high prices overall continued to weigh on inventories, while sustained economic weakness led to the most downbeat outlook in the survey’s history.

The headline seasonally adjusted S&P Global Egypt Purchasing Managers’ Index (PMI) – a composite gauge designed to give a single-figure snapshot of operating conditions in the non-oil private sector economy – posted at 47.3 in April and below the 50.0 neutral mark. However, the index rose from 46.7 in March to its highest since October last year, signaling that business conditions declined to a lesser extent.

The slower rate of decline was reflected in the Output and New Orders PMI measures, which rose to six- and four-month highs respectively in April. However, they still signaled notable contractions in activity and sales across the non-oil economy. According to surveyed businesses, weak client demand linked to high inflation continued to play a key part in dampening sales. Restrictions on imported goods were also still cited by companies as an inhibitor to capacity levels.

While manufacturing, wholesale & retail and services recorded declines in output and new work, the construction industry registered growth for the first time in ten months.

The latest survey data also suggested that inflationary pressures were easing from the multi-year highs seen towards the end of 2022. A more stable currency market – reflected in a more balanced exchange rate against the US dollar – and improving global supply conditions meant that firms faced a softer round of purchase price inflation in April. Furthermore, staff wages rose only slightly and at the weakest pace for eight months. As a result, total input costs increased to the least extent in exactly one year, and the rate of inflation was below the series long-run trend.

With cost inflation slowing, and reported efforts to boost sales, the rate of increase in output prices softened for the third consecutive month and was the least marked since last August.

High material prices meanwhile contributed to a fall in purchasing activity in April, as businesses often chose to draw on their inventories to meet new orders. Stock levels decreased for the sixth month running. Lead times lengthened again, though only marginally.

Non-oil companies continued to register a degree of spare capacity in April, leading to a fall in backlogs of work for the third month running. That said, the reduction was only mild and somewhat constrained by import shortfalls. Amid the drop in workloads, firms reduced their headcounts for the fifth month in a row, although the latest cut was only fractional and the slowest seen in this sequence.

Despite some positivity from a softer rate of cost inflation, firms’ output expectations for the year ahead fell to their weakest on record in April. Businesses noted that weak demand both domestically and abroad, and high price levels, meant that the path for future activity was still highly uncertain.

Comment

David Owen, Senior Economist at S&P Global Market Intelligence, said:

“The latest PMI figures for Egypt provided some promising hints for the direction of the non-oil economy, particularly on inflation. Relative calmness in currency markets led to reduced pressure on import prices, culminating in the softest rise in purchase costs for a year and one that was weaker than the trend rate. The slowdown encouraged firms to raise their own charges to a lesser extent, which helped to partly alleviate the downturn in sales. Indeed, new orders fell at the softest pace for four months, although still markedly overall. “The findings suggest that headline inflation in Egypt should begin to soften over the coming months after hitting a near six-year high of 32.7% in March, which will help to ease the cost-of-living crisis. Similarly, weaker price rises should eventually translate into reduced pressure on demand and activity. Nevertheless, there remains a high degree of uncertainty in future economic conditions, leading firms to post their weakest outlook for activity levels in the series 11-year history.”