The Egyptian government has allocated almost $35 billion to repay debt and loan instalments during the 2020/2021 fiscal year which started in July, an official report has revealed.

Last year, the Egyptian government repaid around $23bn to its creditors.

Minister of Finance Mohamed Maait said previously that Egypt has repaid loans of more than $100bn over the past five years.

Data from the Central Bank of Egypt indicates that the country’s foreign debt increased by 4.78 per cent on an annual basis during the third quarter of the fiscal year 2019/2020, to $111.3bn.

However, unofficial estimates suggest that Egypt’s foreign debt has exceeded the $120bn mark having received two new loans from the International Monetary Fund totalling $8 billion to cope with the repercussions of the coronavirus pandemic.

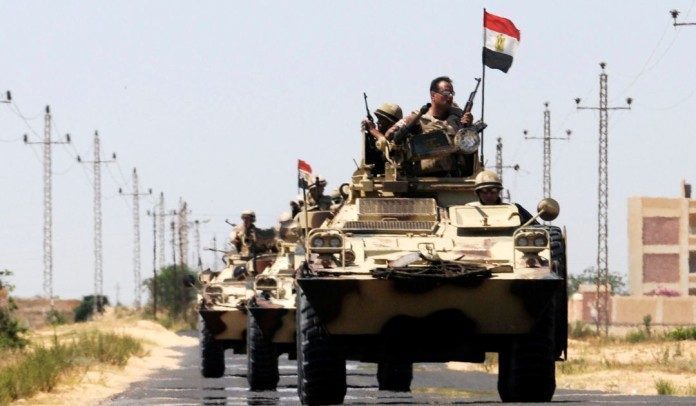

Egypt’s domestic and foreign debt has doubled since the then General Abdel Fattah Al-Sisi led a military coup and ousted democratically elected President Mohamed Morsi in July 2013.

Egypt’s external debt hits $111.3bn

Egypt’s external debt rose 4.78 per cent during the third quarter of the last financial year 2019-20, reaching $111.3 billion, the Central Bank of Egypt (CBE) announced yesterday.

“Egypt’s external public debt rose from $106.22 billion during the third quarter of the previous financial year 2018-19,” the CBE said in a report, adding that the country’s external debt had dropped by $1.4 billion in December 2019.

Egypt has been negotiating billions of dollars in aid from various lenders to help revive an economy that was hit by political upheaval since a 2011 revolution and to liquidate the state’s foreign reserves. The country’s need for foreign exchange has increased throughout the current year, due to the repercussions of the novel coronavirus.

On 31 August 2020, the Egyptian government signed a $2 billion Islamic financing loan agreement “to support the state’s budget”.

Egypt’s financial year starts in July and ends in June of the following year.