Despite Egypt’s efforts to develop its business climate and put it on track to revive its wrecked economy after years of turmoil, many challenges are still facing the North African country.

The London-based Capital Economics said in a research note that as the Arab world’s most populous country and the biggest economy in North Africa paved the way to attract more foreign direct investment through passing a new investment law, however greater efforts are needed to meet to return back Egypt’s economy on track.

It said,”The new Investment Law is a positive step towards improving the dire business environment. But greater efforts, particularly in raising domestic savings, are needed if investment is to reach the levels that historically have supported strong and sustained growth in other emerging markets.”

Earlier this month the Egyptian parliament passed a long-awaited new investment law in a bid to improve the business environment and encourage investment,

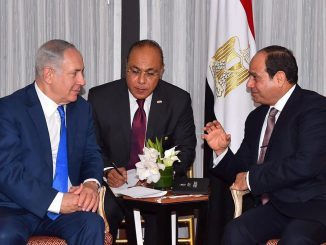

Once approved by Abdel Fattah Al-Sisi, the legislation will replace the previous 1997 law, to which widely criticized amendments were made in 2015.

But Capital Economics doesn’t think that the new investment law will go far enough.

The research note explained,” The establishment of certification offices merely masks the bloated bureaucracy, which investors are still likely to come up against. Meanwhile, the right to repatriate profits and establish private free zones merely reverses previous policy decisions that prevented these. And there are also concerns that the new law could foster corruption.”

Egypt’s new investment law sets new “certification offices”that will be set up to review applications and supporting documents for licences, allowing investors to side-step the slow bureaucracy.

The authorities have also granted investors the right to repatriate profits without restriction as the foreign currency crunch that hit the country after floating the pound last November came to an end.

The research said, “In particular, the ability of the authorities to allocate free plots of land for ‘strategic business activities’ is a worrying hark back to the land deals that—among other things—tainted the Mubarak regime.”

Capital Economics believes that low investment is a concern as it results in poor infrastructure, and this means the country is slow at adopting new technologies, all of which hinder productivity growth and increases in living standards.

It said, “The poor business environment is one factor behind the country’s extremely low investment rate of just 15% of GDP.”

Egypt is one of the toughest places in the world to conduct business. Egypt ranked 122 out of 190 in the World Bank’s latest “Doing Business” survey.

Capital Economics also said that Egypt’s investment rate is constrained by the country’s extremely low domestic savings rate of around 10% of GDP.

It said, “This matter limits the pool of resources available for investment, forcing the country to borrow from abroad to meet its investment needs, which has a counterpart in the current account deficit.”

Moreover, it stated that,”The new law may help attract more foreign capital inflows, but if Egypt’s overall investment rate is to rise to the levels of 25% of GDP that, historically, have supported sustained rises in living standards in other emerging markets, efforts to raise the domestic savings rate will be crucial.”